Nubank | 2021

Multiple virtual cards

Description

How we enabled Nubank's customers to have more security and organized spending rethinking the Virtual Cards in Brazil.

Role

Lead Product Designer

Problem

How can we enable Nubank's customers to have a more secure and organized online spending?

We had by the time a huge load on the contact rate due to cards being lost or frauded, that generated a cost spike of reissuing credit cards and a lot of insecurity for the customers to use our product.

Hypothesis

If we designed a way to make the card more secure, that would reduce drastically the three main KPIs of the team, contact rate, fraud and cost reduction. For that, the main assumption was to develop new layers on the current Virtual Card, and provide the ability to create, delete and manage on the customer side.

User research

To validate the hypothesis we had, we did a series of in-depth interviews with 10 customers to map the user needs and pain points, also a desk research to understand the data behind the opportunity and reality of our current product.

With the research finished I unfolded the 2 main pillars into 4 epics that we later implemented in our product in order to have a complete end-to-end experience and also to better "sell" the product to the users. Those 4 epics were, Communication strategy, Temporary (finite) cards, Multiple virtual cards, and Accessibility.

Design

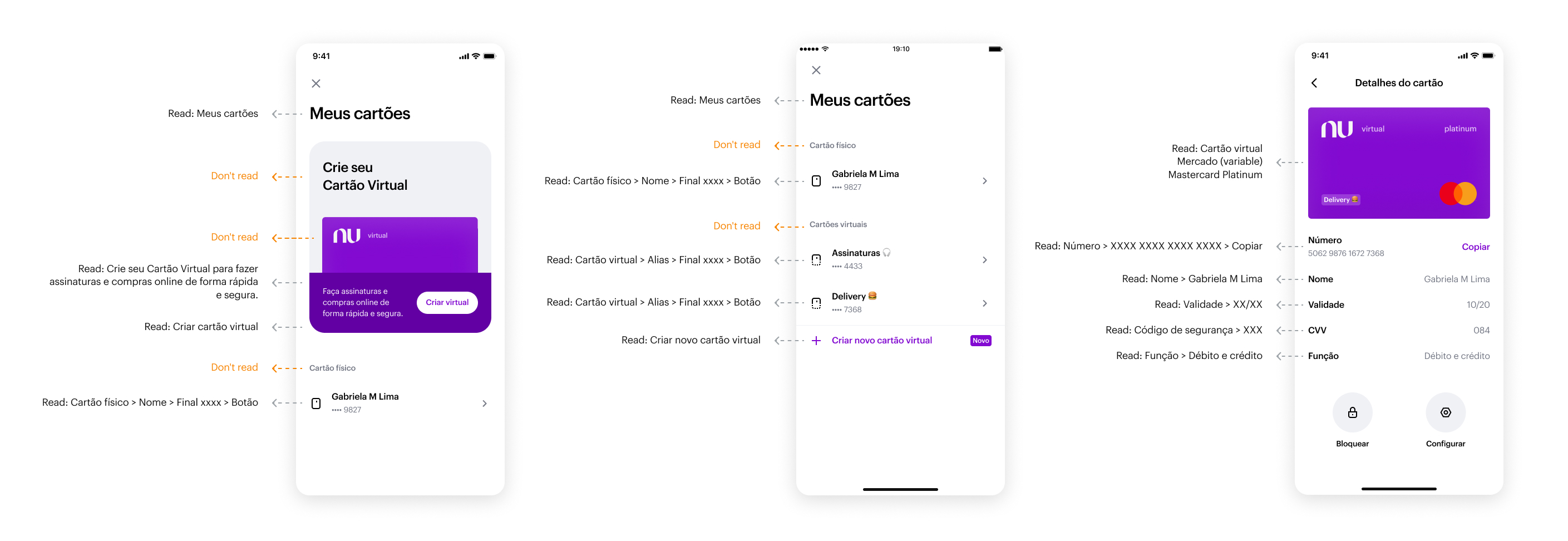

We ran an unmoderated usability test with two versions to see how the users behave doing the most common tasks around managing cards inside Nubank's app, like crating a Virtual Card, Blocking or Copying the number for an online purchase.

Accessibility

One of the most important aspects of our product that was solved in a very simple way was the accessibility side of it. By the time, Nubank had removed the numbers texture on the physical card, making it a bad experience for visually impaired people, to solve that we mapped and create a read flow inside the Card Management to make sure they could easily do their purchases using the voice over.

Impact

Shortly after releasing the updated virtual cards flow at Nubank, key indicators revealed a measurable improvement—validating our user-centered, problem-focused approach.

Contact rate

Reduction in the contact rate generated by card's reissue.

Credit card reissuing

Customers that used the virtual cards had a reduction in requests for card reissuing, due to the controls being available for them to block and delete whenever they want.

Fraud

Overall reduction in the fraud indicators as the users involved in the roll out had more control on their virtual card.

Nubank | 2021

Multiple virtual cards

Description

How we enabled Nubank's customers to have more security and organized spending rethinking the Virtual Cards in Brazil.

Role

Lead Product Designer

Problem

How can we enable Nubank's customers to have a more secure and organized online spending?

We had by the time a huge load on the contact rate due to cards being lost or frauded, that generated a cost spike of reissuing credit cards and a lot of insecurity for the customers to use our product.

Hypothesis

If we designed a way to make the card more secure, that would reduce drastically the three main KPIs of the team, contact rate, fraud and cost reduction. For that, the main assumption was to develop new layers on the current Virtual Card, and provide the ability to create, delete and manage on the customer side.

User research

To validate the hypothesis we had, we did a series of in-depth interviews with 10 customers to map the user needs and pain points, also a desk research to understand the data behind the opportunity and reality of our current product.

With the research finished I unfolded the 2 main pillars into 4 epics that we later implemented in our product in order to have a complete end-to-end experience and also to better "sell" the product to the users. Those 4 epics were, Communication strategy, Temporary (finite) cards, Multiple virtual cards, and Accessibility.

Design

We ran an unmoderated usability test with two versions to see how the users behave doing the most common tasks around managing cards inside Nubank's app, like crating a Virtual Card, Blocking or Copying the number for an online purchase.

Accessibility

One of the most important aspects of our product that was solved in a very simple way was the accessibility side of it. By the time, Nubank had removed the numbers texture on the physical card, making it a bad experience for visually impaired people, to solve that we mapped and create a read flow inside the Card Management to make sure they could easily do their purchases using the voice over.

Impact

Shortly after releasing the updated virtual cards flow at Nubank, key indicators revealed a measurable improvement—validating our user-centered, problem-focused approach.

Contact rate

Reduction in the contact rate generated by card's reissue.

Credit card reissuing

Customers that used the virtual cards had a reduction in requests for card reissuing, due to the controls being available for them to block and delete whenever they want.

Fraud

Overall reduction in the fraud indicators as the users involved in the roll out had more control on their virtual card.

Nubank | 2021

Multiple

virtual cards

Description

How we enabled Nubank's customers to have more security and organized spending rethinking the Virtual Cards in Brazil.

Role

Lead Product Designer

Problem

How can we enable Nubank's customers to have a more secure and organized online spending?

We had by the time a huge load on the contact rate due to cards being lost or frauded, that generated a cost spike of reissuing credit cards and a lot of insecurity for the customers to use our product.

Hypothesis

If we designed a way to make the card more secure, that would reduce drastically the three main KPIs of the team, contact rate, fraud and cost reduction. For that, the main assumption was to develop new layers on the current Virtual Card, and provide the ability to create, delete and manage on the customer side.

User research

To validate the hypothesis we had, we did a series of in-depth interviews with 10 customers to map the user needs and pain points, also a desk research to understand the data behind the opportunity and reality of our current product.

With the research finished I unfolded the 2 main pillars into 4 epics that we later implemented in our product in order to have a complete end-to-end experience and also to better "sell" the product to the users. Those 4 epics were, Communication strategy, Temporary (finite) cards, Multiple virtual cards, and Accessibility.

Design

We ran an unmoderated usability test with two versions to see how the users behave doing the most common tasks around managing cards inside Nubank's app, like crating a Virtual Card, Blocking or Copying the number for an online purchase.

Accessibility

One of the most important aspects of our product that was solved in a very simple way was the accessibility side of it. By the time, Nubank had removed the numbers texture on the physical card, making it a bad experience for visually impaired people, to solve that we mapped and create a read flow inside the Card Management to make sure they could easily do their purchases using the voice over.

Impact

Shortly after releasing the updated virtual cards flow at Nubank, key indicators revealed a measurable improvement—validating our user-centered, problem-focused approach.

Contact rate

Reduction in the contact rate generated by card's reissue.

Credit card reissuing

Customers that used the virtual cards had a reduction in requests for card reissuing, due to the controls being available for them to block and delete whenever they want.

Fraud

Overall reduction in the fraud indicators as the users involved in the roll out had more control on their virtual card.